kaufman county tax appraisal

VALUES DISPLAYED ARE 2022 PRELIMINARY VALUES AND ARE SUBJECT TO CHANGE PRIOR TO CERTIFICATION. Oconnor is the leading company representative for the Kaufman County Appraisal District property owners because.

County tax assessor-collector offices provide most vehicle title and registration services including.

. Kaufman County Appraisal District makes no warranty or guarantee concerning the accuracy or reliability of the content at this site or at other sites to which we link. Remember to have your propertys Tax ID Number or Parcel Number available when you call. Information provided for research purposes only.

Scroll to see the property features tax value mortgage calculator nearby schools and similar homes for sale. Ad Uncover Available Property Tax Data By Searching Any Address. To submit a form and to view previously submitted forms you must have an Online.

Vehicle Registration 469-376-4688 or Property Tax 469-376-4689 Kaufman County Tax Office Locations. REDUCE PROPERTY TAXES. A convenience fee of 229 will be added if you pay by credit card.

May I pay my taxes by phone in Kaufman County TX. At the prompt enter Jurisdiction Code 6382. Ad Just Enter your Zip for Appraised Values in your Area.

See Recently Appraised Property Values Online. Kaufman Central Appraisal District. For over 20 years OConnor has.

Brenda Samples Kaufman County Tax Assessor Hours. Just Enter Your Zip to Start. You can view submit and manage your forms all in one place.

Browse HouseCashins directory of 68 Kaufman County top tax advisors and easily inquire online about their property tax protest consulting services. Kaufman County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Kaufman County Texas. M - F in.

Your Home Deserves The Best - Connect With A Top Rated Local Appraisal Expert. 11493 Fm 2860 currently not for sale is located in Kaufman County. Kaufman County Property Tax Appraisal.

Ad Before you make plans to sell get a free and instant valuation online. Kaufman County collects on average 2 of a propertys assessed. The eligibility of the property for exemption.

Search could not be preformed at this time. We Provide Homeowner Data Including Property Tax Liens Deeds More. You can pay your property taxes by calling 1-800-2PAY-TAX 1-800-272-9829.

The median property tax in Kaufman County Texas is 2597 per year for a home worth the median value of 130000. Ad Before you make plans to sell get a free and instant valuation online. You can call the Kaufman County Tax Assessors Office for assistance at 972-932-4331.

Please try again later. Use UpDown Arrow keys to increase or decrease volume. The Appraisal District is giving public notice of the capitalization rate to be used each year to.

The median property tax on a 13000000 house is 260000 in Kaufman County. City of Forney 101 Main Street East Forney TX 75126. Ad Angi Matches You to Experienced Local Appraisers In Minutes.

PO Box 819. The median property tax on a. The median property tax on a 13000000 house is 235300 in Texas.

To pay by telephone call 1-866-549-1010 and enter Bureau Code 5499044. The grant denial cancellation or other change in the status of an exemption or exemption application. Registration Renewals License Plates and Registration Stickers.

Expert Results for Free. Welcome to Kaufman CAD Online Forms. Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs.

They are maintained by. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

Real County How To Protest Property Taxes

![]()

Tax Info Kaufman Cad Official Site

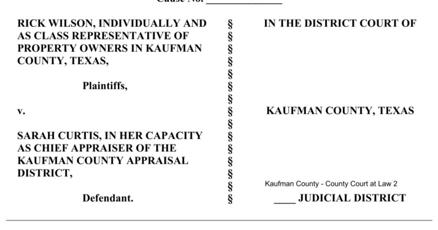

Forney Mayor Files Suit Against County Appraisal District Business Inforney Com

Property Values Rising Again In Kaufman County Around Town Kaufmanherald Com

Censored Property Taxes Texas Hunting Forum

It S Property Tax Appraisal Season Fireboss Realty

Kaufman Central Appraisal District Facebook

Kaufman Central Appraisal District Facebook

Don T Forget To File Your Homestead Exemptions Appraisal Home Trends Home Hacks

What Are Property Valuations And How Do They Effect My Property Taxes Youtube